“With my retirement being seized, I had nothing to live on.”

-Glenn

Consumer Law

Everyone creates consumer contacts, sometimes several times a day. Usually, both parties make and execute the contract in good faith. Sometimes, though, one of the parties aims to defraud the other – taking the money without providing the good or service. In these situations the poor turn to legal aid to get to help them get their money back or prevent the collection of unjust debt. Without that help the poor lose their savings, become saddled with unjust debt, and drop in creditworthiness.

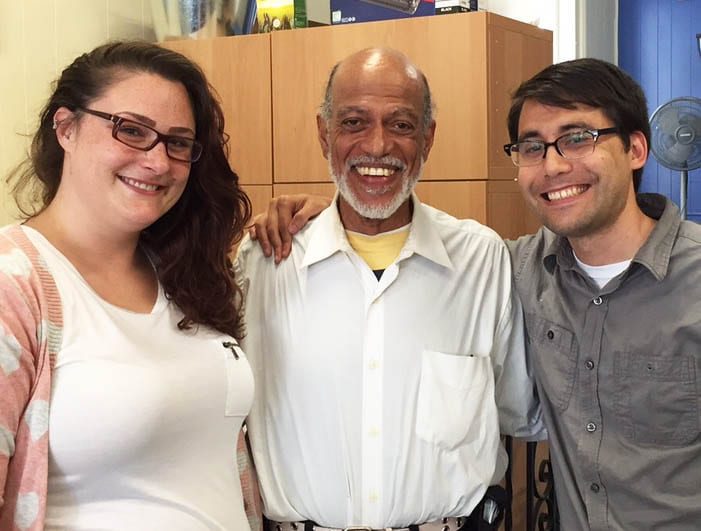

Featured Story: Glenn Evans

Once a computer pioneer, now a sufferer from Dementia, Glenn had racked up tens of thousands of dollars in debt due to a faulty memory. Now his retirement and tax returns are being seized and he’s been forced to live out of his car.

Understanding the Issue

Identity Theft

It’s shockingly easy to steal someone’s identity and make purchases in their name, especially against disabled individuals. Even worse, the poor lack many of the fraud protections middle class Americans take for granted. We’ve seen tens of thousands of dollars in purchases made in the span of a few days by perpetrators – damage that can take a lawyer years to undo.

Contract Fraud

Bankruptcy

Sometimes people are forced into making extraordinary expenses, such as ambulance fees worth tens of thousands of dollars. Other times the loss of a job results in deep indebtedness. In these situations the appropriate legal remedy is bankruptcy. Ironically, the poor are rarely able to afford bankruptcy: private bankruptcy lawyers require several thousand dollars in upfront fees before actually filing the bankruptcy. Without legal aid, these people are destined to spend many years or even decades destitute.

All Consumer Stories

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

- Peter Holland, Evaluation of the Pro Bono Resource Center Consumer Protection Project (2013) at 6-7.